GET TO KNOW US

Inspiration is the most important part of our strategy.

With over a decade of experience our trained staff continously pushes the envelope in the automotive industry. With us being highly certified, we are able to navigate automotive claims with ease.

Being in the industry as long as we have; we have spotted the techniques the insurance carriers use in order to minimize the payout of the claim to keep money in their pocket. Often times, this leads to an improper repair of your vehicle.

Insurance carriers pay millions to train their employees to mitigate damages to keep their bottom line low. That being said, no one is in the customers corner. If insurance sends you to their suggested shop; then the carrier is telling them how they would like the repair to be done.

Summary of our stats

Happy Customers

0

+

Won for Clients

$

0

+

Experience

0

+

Auto Insurance Claims

Our stance on auto insurance claims is to maximize the payout on behalf of the customer in order to allow for a proper repair. Occasionally, we will partner with a non-direct repair facility in order to oversee that the insurance adjuster is not attempting to cut corners.

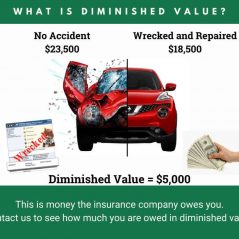

Auto Diminished Value Claims

When you are in a collision not caused by you; the other parties insurance company owes you additional funds after the repair has been completed. This is the attempt to collect the gap between what your car was worth before and now after the wreck.